greenville county property tax estimator

Greensville County collects on average 055 of a propertys. Often your questions can be answered quickly via email.

Food Insecurity In Greenville County Gvltoday

866-549-1010 Bureau Code 8488220.

. The median property tax on a 14810000 house is 97746 in Greenville County. Greenville County collects on average 066 of a propertys. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County.

Estimated Range of Property Tax Fees. Learn all about Greenville County real estate tax. Pay by Phone for Property Tax.

There are typically multiple rates in a given area because your state county local. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current. For a list of. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

Greenwood County Tax Estimator South Carolina SC. For comparison the median home value in Greenville County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Thank you for your patience while we upgrade our system. Tax Collector Suite 700. The median property tax in Greensville County Virginia is 523 per year for a home worth the median value of 94600.

If paying by mail please make your check payable to Greenville County Tax Collector and mail to. Please note that we can only estimate your property tax based on median property taxes in your area. Welcome to the Greenville County Geographic Information Systems GIS homepage.

For comparison the median home value in South Carolina is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

For comparison the median home value in Laurens County is. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property. Lexington County explicitly disclaims any representations and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

No title work after 345 pm in the Motor Vehicle Department. For an estimation on county taxes please visit the Greenville county or Laurens county. Our mission is to provide accurate and timely geographic information system.

Why Retire In Greenville Sc Retiring In Greenville Guide

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

South Carolina Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

How Greenville County Assesses Taxes The Home Team

How Greenville County Assesses Taxes The Home Team

Deep Dive Fee In Lieu Of Tax Agreements Remain A Useful Tool In Attracting Investment Greenville Journal

United Way Of Greenville County Uwgreenvillesc Twitter

Greenville County Council Candidates Answer Our Questions

United Way Of Greenville County Uwgreenvillesc Twitter

Greenville Sc Real Estate Market Trends And Forecast 2020

Property Tax How To Calculate Local Considerations

Why Are Texas Property Taxes So High Home Tax Solutions

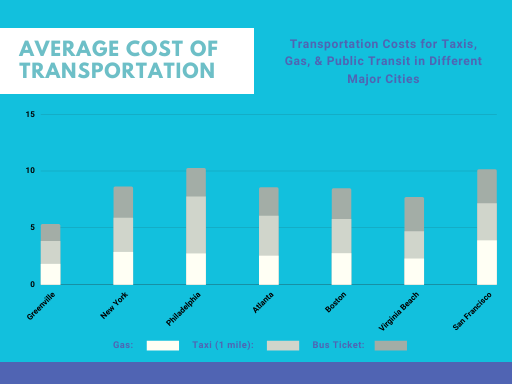

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Greenville County Schools Passes 715 Million Budget With Pay Raises

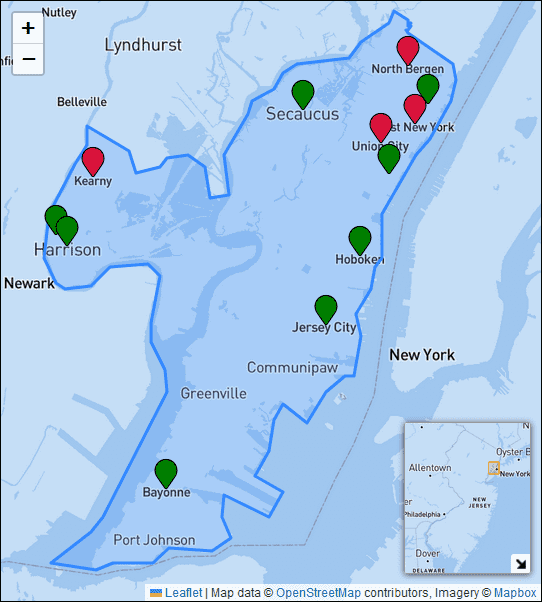

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation